us exit tax rate

Currently net capital gains can be taxed as high as 238 including the net. The exit tax is a tax on the built-in appreciation in the expatriates property such as a house as if the property had been sold for its fair market value on the day before expatriationThe current maximum capital gains rate is 238 which includes the 20 capital gains tax and the 38 net investment income tax.

Exit Tax Us After Renouncing Citizenship Americans Overseas

The IRS Green Card Exit Tax 8 Years rules involving US.

. The total amount of the gift is reduced by the annual gift exclusion 13000 in 2011 and then subject to the highest marginal. Green Card Exit Tax 8 Years Tax Implications at Surrender. Having planned and executed an entry into the US.

The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. The IRS requires certain expats to calculate an exit tax when they exit the US and file their 10401040NR tax return along with Form 8854. Any gifts or bequests that you make as a covered expatriate to a US.

If the rate is 25 per cent but no tax is paid in the new country of residence there is no double tax. Citizen renounces citizenship and relinquishes their US. Tax resident or citizen by virtue of having acquired a green card or citizenship see Garcia Tax Planning for High-Net-Worth Individuals Immigrating to the United States The Tax Adviser April 2016 and Garcia and Qian Tax Planning for a.

Permanent Residents Approaching the 8-Year LTR Mark and want to Pull the Cord. Green Card Exit Tax 8 Years. Once you have paid the exit tax either in a giant lump sum up front or because of the 30 withholding made on payments as you receive them you have cash in your pocket.

However a retirement fund such as a 401K is a free tax income as you havent paid any tax on this. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Also one may be able to claim a foreign tax credit in the other country based on the Canadian tax depending on the tax rules of that country 3 PAYING A DEPARTURE TAX.

In some cases you can be taxed up to 30 of your total net worth. The general proposition is that when a US. The exit tax is an income tax on 1 unrealized gain from a deemed sale of worldwide assets on the day prior to expatriation.

Long-Term Residents who are Over 8 Years and Considered Long-Term Residents. In the United States the expatriation tax provisions under Section 877 and Section 877A of the Internal. If the IRS can rely on tax withholding rules to assure full collection of income tax the covered expatriate pays tax at a 30 rate on US.

You are free to move about the planet. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. The failure to file the necessary US.

Exit Tax Expatriation Planning. Legal Permanent Residents is complex. As provided by the IRS.

Puerto Rico Act 60 Formerly 20 and 22 US Expatriation Alternative. Citizen will be subject to provisions of the exit tax. The phrase exit tax that we use consists of four different ways in which you.

US Exit Tax IRS Requirements. Expatriation forms may result in FBAR penalties FATCA penalties PFIC tax passport revocation liens levies and examination. Tax person may have become a US.

The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. Status they are subject to the expatriation and exit tax rulesBut the rules are not limited to. An expatriation tax is a tax on someone who renounces their citizenship.

The IRS will not tax you a second time. Exit Tax Consists of Several Things. Calculating the exit tax is tricky in general but if youve got retirement accounts and foreign pensions it jumps to a whole new level of complexity.

The Exit Tax Planning rules in the United States are complex. If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is charged a 30 withholding tax on their deferred compensation. The IRS considers the present net value the type of pension or retirement account estimated accrued benefit of future distributions where the pension is held and where the work was done and.

It will be as though you had sold all of your assets and the gain generated was viewed as taxable income. For example if you made a profit of 750000 on your assets exit tax would only apply to 25000 of that amount. Presuming the person who expatriates qualifies as a covered expatriate they will have to conduct an exit tax analysis using Form 8854.

US Taxpayers Expecting a Financial Windfall and want to Avoid US Tax. And 2 the deemed distribution of IRAs 529 plans and health savings accounts taxed at ordinary income rates. If the covered expatriate does not meet the aforementioned criteria then the deferred compensation is taxed as income based on the.

If you are covered then you will trigger the green card exit tax when you renounce your status. The most important aspect of determining a potential exit tax if the person is a covered expatriate. If the profit on your assets is over 725000 you only have to pay exit tax on the amount that is over the threshold.

Source income as it is received. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

Tax system a formerly non-US.

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

The Taxes That Raise Your International Airfare Valuepenguin

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

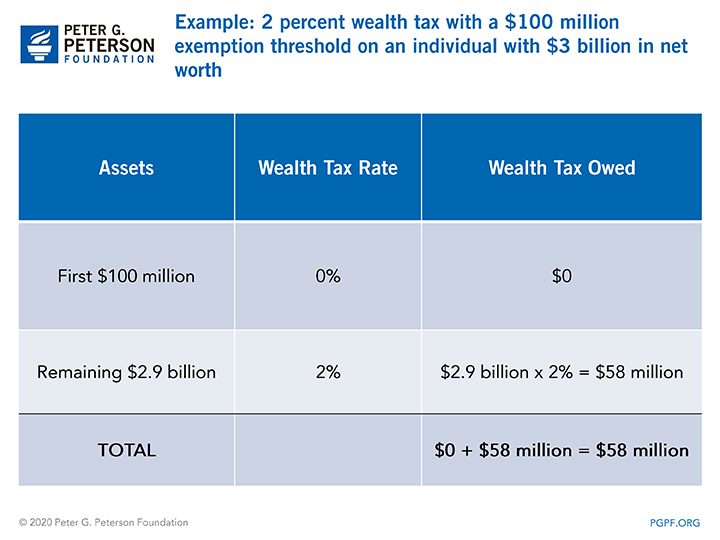

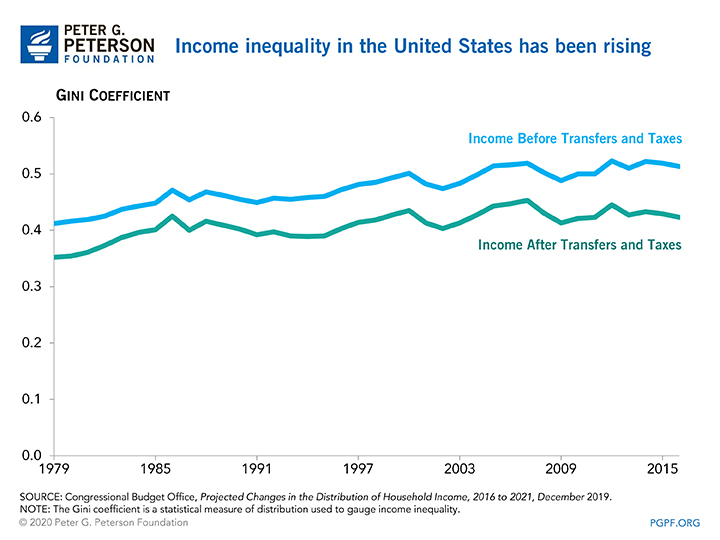

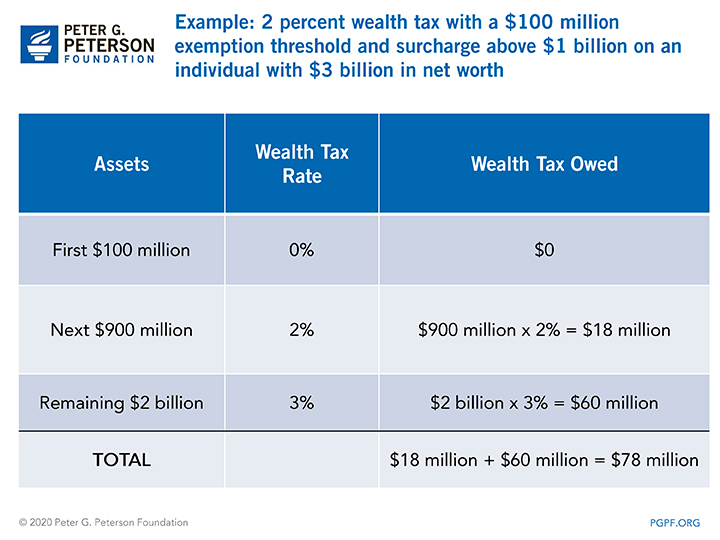

What Is A Wealth Tax And Should The United States Have One

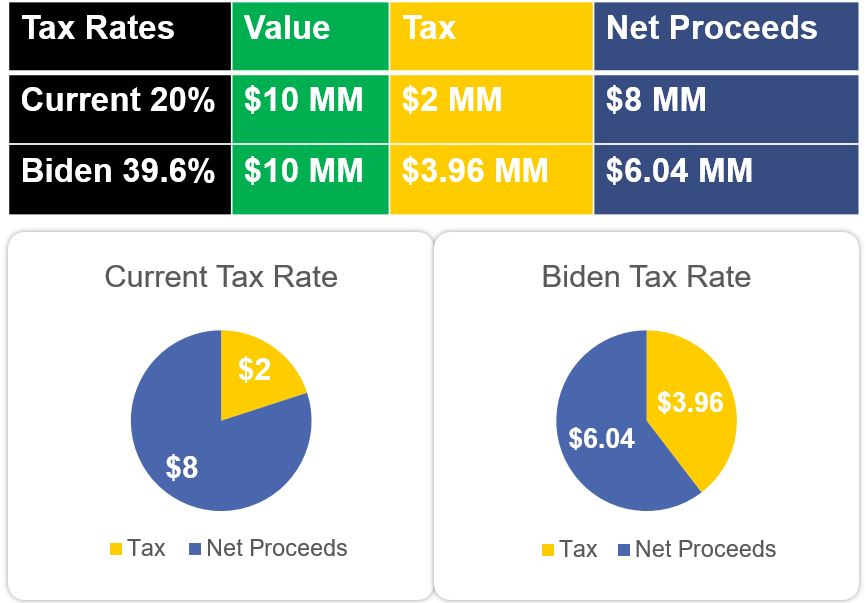

The Proposed Biden Tax Plan Will Double Taxes When Selling Your Business Affinity Ventures

What Is A Wealth Tax And Should The United States Have One

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Exit Tax Us After Renouncing Citizenship Americans Overseas

What Is A Wealth Tax And Should The United States Have One

Benefits Of Renouncing Us Citizenship And Retiring With Ease

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Travelers Beware Of Increased Airport Departure Tax In The Maldives Premium Class Now Up To 180 Loyaltylobby

Wealth Taxes Often Failed In Europe They Wouldn T Here The Washington Post

Exit Tax Us After Renouncing Citizenship Americans Overseas